January 21, 2026

U.S. Credit Bureaus Industry – Weathering a Tight Credit Cycle

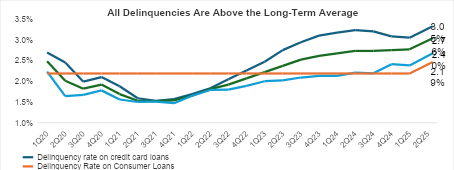

The U.S. Credit Bureaus (CBs) industry is navigating through one of the tightest financial conditions since the 2000s. Interest rates are high; inflation is elevated and delinquencies in consumer credit, though improving, are on the higher side of the historical average. Industry revenue has accelerated in recent quarters, as the impact of weak credit marketplace volumes was more than offset by growth from diversification into other streams. The support from services such as verification, identity & fraud controls, analytics, advanced scoring models and newer businesses has bolstered the credit metrics and lending conditions for the sector even as the core business faces a tough cycle.

Broad-Based Growth Tailwinds

Looking ahead, industry performance is likely to remain strong over 2026–2027 as U.S. consumer credit quality stabilizes, delinquency rates decline, and anticipated interest rate cuts prompt banks to ease underwriting standards. At the same time, credit origination volumes should be supported by stronger credit demand, driven by rising lender and consumer confidence and improving real incomes. Persistent demand for employment and income verification, including government program use cases, will continue to provide a steady tailwind. Accelerated AI-led product innovation on modern cloud and data platforms, together with renewed momentum across fintech and marketplace channels, is expected to underpin a constructive medium-term outlook.

Pass-Through Caps Significant Margin Upside

Industry profitability is likely to improve modestly, driven by solid revenue growth. However, meaningful margin expansion remains constrained by the commoditized nature of these services and the pass-through of AI-related cost savings to clients.

Lower Lender Risk: Light Capex, Self-Funded Working Capital

Near‑term Capex is light as AI‑led product innovation on modern cloud and data platforms reduces on‑prem spend. At the same time, automation in consumer operations strengthens operating leverage and ROI, supporting a lean capex model. Lender risk is also likely to moderate, with cash flows underpinned by recurring verification and analytics usage and consumer subscriptions. Improving profitability and operating leverage indicate that near-term working capital requirements can largely be funded from internal accruals rather than additional borrowings.

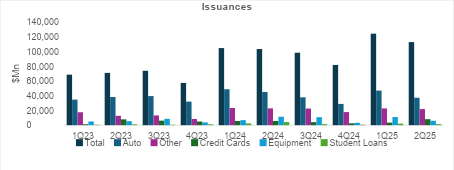

Originations: Recovery from a Low Base

Credit card account originations have declined since September 2022 but ticked up recently from a low base as credit quality improved. Auto originations fell from March 2022 to November 2023, turned volatile through 2024, and saw an early-2025 uptick driven by tariff-related pull-forward that has since faded.

Delinquency Trends: Improving but Above Average

Delinquencies fell to decade lows in 2021, supported by elevated savings, stimulus effects and reduced discretionary spending. They rose after 2022 with softer savings, higher rates & inflation, and fading supports. By 2Q25, trends improved across non-mortgage categories, signaling steadier household debt service, though levels remain above long-term averages.

Broader Fundamentals: Improving

Unemployment rose to 4.4% in September but remains below the 5.7% long-run average, indicating a still-tight labor market that supports incomes and verification demand while lenders remain selective, favoring prime borrowers and disciplined pricing. A below average unemployment rate and a tight labor market should support consumer and lending in non-mortgage originations in event of continued rate cuts.

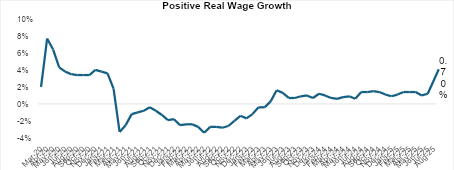

Positive Real Wage Growth

Real wages increased 0.7% in August, providing a modest boost to household purchasing power. However, real wage growth has softened notably since March 2025, from 1.4%, signaling a loss of momentum in labor income. While this deceleration suggests that the real‑income tailwind to consumer spending could fade, positive real wage growth should still help stabilize credit performance and delinquency rates relative to the period of negative real wage growth in 2021–22.