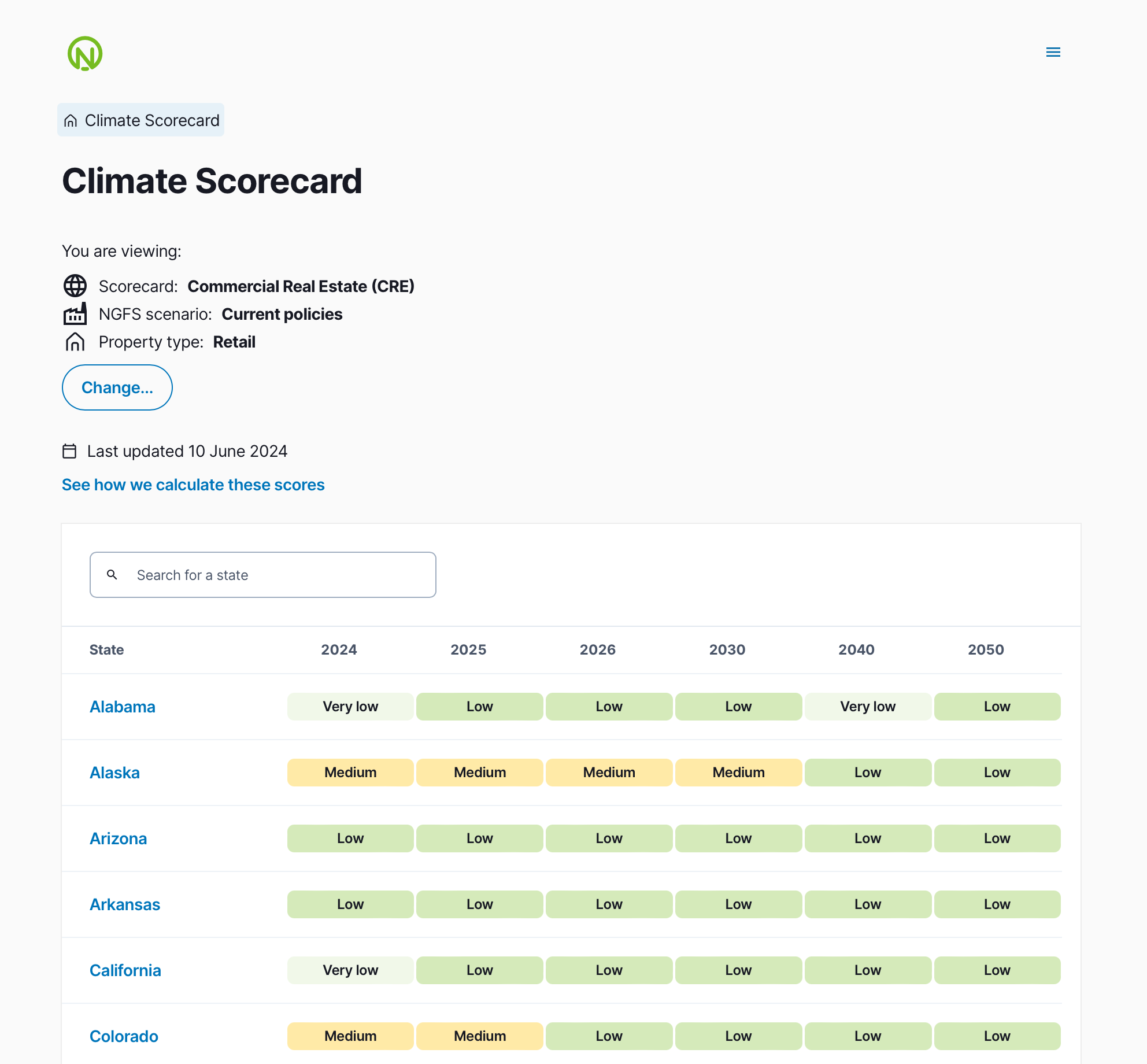

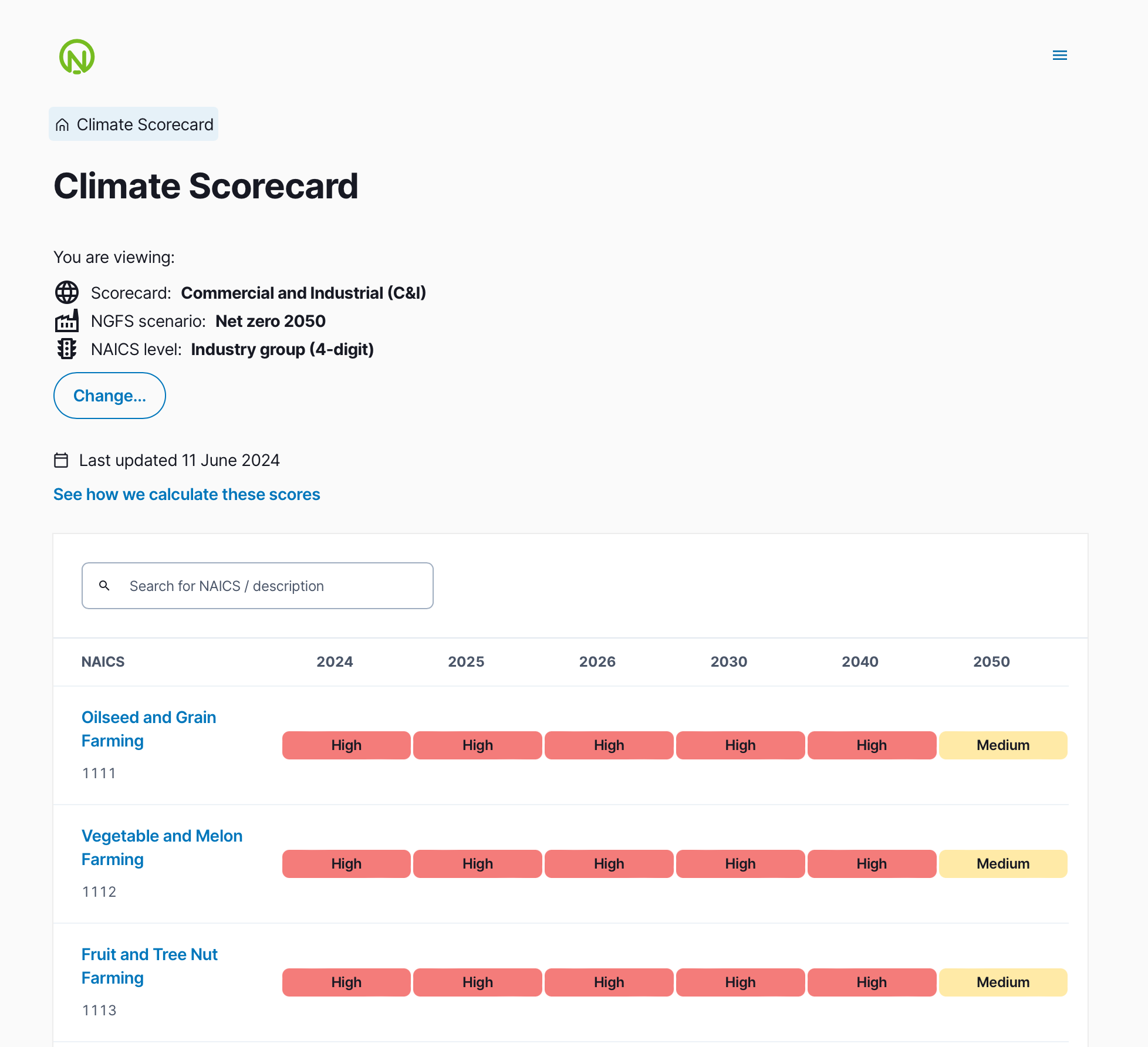

Climate Scorecard

Get a clear view of transition risk across your portfolio

Precise and actionable insight

Our Climate Scorecard provides a clear view of how climate transition impacts different sectors over multiple time horizons, allowing stakeholders to better understand and manage the specific risks associated with the shift to a low-carbon economy.

Get access to annual climate risk projections up to 2050 for each industry and property type.

Gain insight into how the risk ratings of an industry will change as the industry transitions over time.

Automatically updated quarterly and aligned with industry standards (NGFS & PCAF), giving you confidence in regulatory compliance.

COMPREHENSIVE COVERAGE

Analyze climate risks for:

-

Commercial & Industrial (C&I) portfolio across all industries with material emissions, at both 4-digit and 6-digit NAICS levels.

-

Commercial Real Estate (CRE) portfolio for up to nine property types across all 50 U.S. states.

-

Inherent climate transition risk using a five-point scale ranging from very low to very high, depending on the sector’s expected transition to a low-carbon economy over time.

FORWARD-LOOKING INSIGHT

-

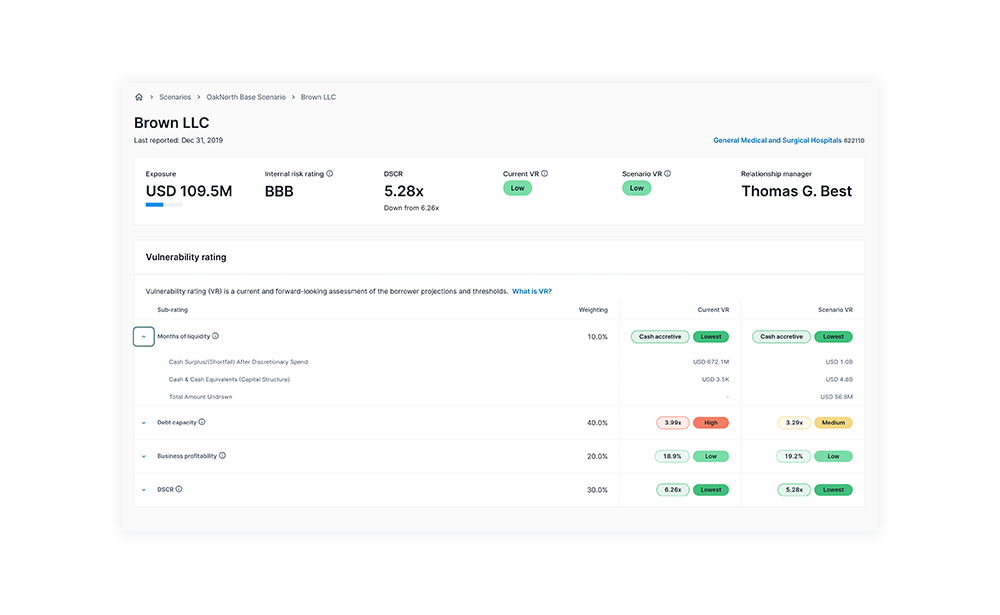

Conduct analysis from the overall portfolio and sector level down to the industry (L5 NAICS) and borrower level

-

Give your teams the data and tools they need to identify the sources of risk and the underlying drivers behind it

-

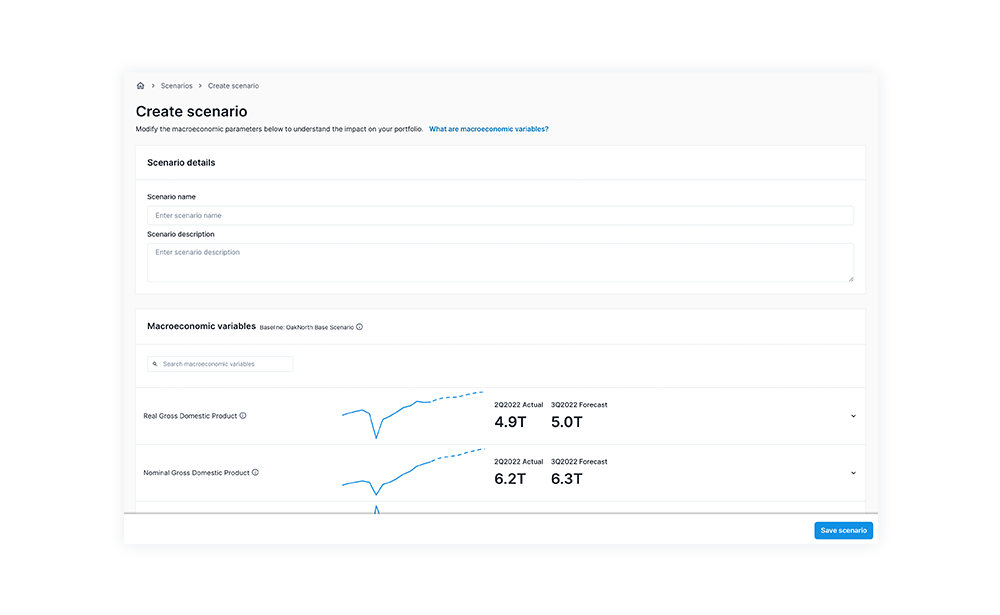

Create configurable scenarios that reflect your internal economic outlook

-

Make informed decisions about the risks and opportunities in your loan book based on the anticipated macro-economic shifts

ACTIONABLE INSIGHTS

Evaluate the drivers that underpin each industry’s transition risk score

-

Benchmark existing internal climate risk assessments.

-

Identify which industries and property types to focus on, using climate scenarios including those required by the Fed’s Climate Scenario Analysis.

-

By isolating climate transition risk, the Scorecard offers valuable insights into the distinct challenges and opportunities that arise from environmental and regulatory changes, independent of traditional credit risk assessments, or borrower operating performance.

IMPROVE CREDIT OUTCOMES

-

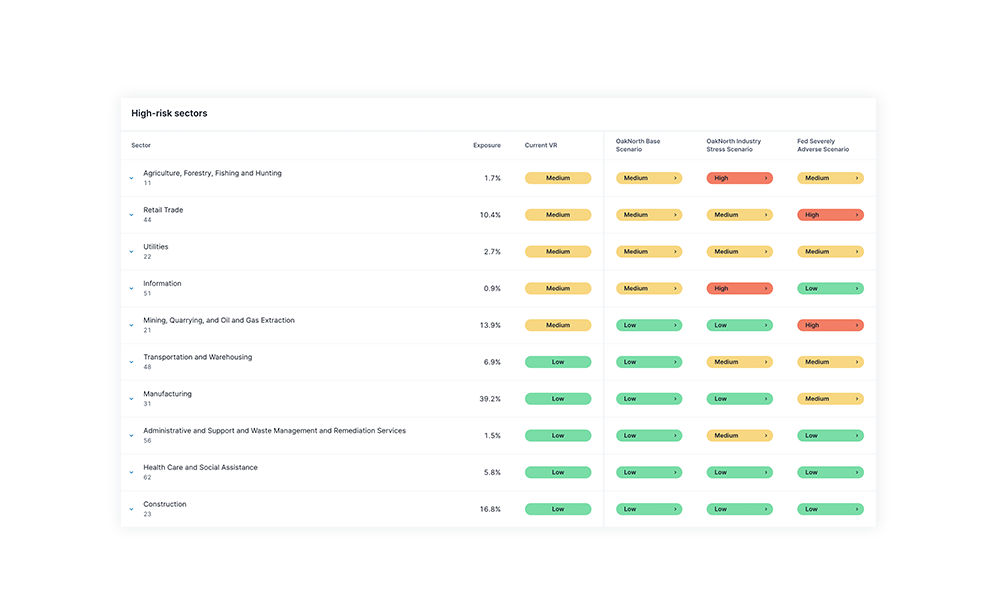

Instantly segment your portfolio and rate loans based on vulnerability to address potential credit issues

-

Identify high-risk industries in your loan book, investigate further, and support your borrower-level view of industry-specific risk

-

Build borrower relationships with a more detailed assessment of their specific industry’s projected performance

-

Get projections of how a borrower would perform under various scenarios at a financial metric level

-

Formulate a targeted risk mitigation strategy for better capital allocation

.jpg?width=1638&height=2000&name=Scorecard-mockup%20(1).jpg)

COST EFFECTIVE

Demonstrate tangible ROI quickly

- Our starter scorecard plan is offered free of charge, giving banks the opportunity to generate ROI quickly and at no cost.

- Our scorecard is designed to be incorporated into your existing risk management frameworks, ensuring a smooth transition and implementation.

Scorecard Plans

Starter

FREENAICS 4-digit only

20 industries

3 property types

10 U.S. states

Net Zero 2050

2024

Standard

$2,950/yrNAICS 4-digit and 6-digit

All industries

5 property types

25 U.S. states

Net Zero 2050

Current policies

2024, 2030, 2050

Pro

$4,950/yrNAICS 4-digit and 6-digit

All industries

PLUS risk drivers write-up for each industry

9 property types

All 50 U.S. states

PLUS risk drivers write-up for each state

Net Zero 2050

Current policies

2024, 2025, 2026, 2030, 2040, 2050

CONFIDENTLY LEND THROUGH CYCLES

Take preventive action to continue confidently lending and supporting borrowers through economic cycles

- Identify the macroeconomic variables that have the greatest impact on your loan book

- Identify the industries and borrowers that contribute the most to changes in performance

- Make targeted decisions through a nuanced forward-looking view of industry-specific risk

- Support borrowers through turbulent cycles with a more detailed forward-looking view of their industry’s projected performance

ON Scenario Analysis Product Tour

Get a personalized tour to see how ON Scenario Analysis provides a range of scenarios to identify risk up to 12 months earlier, all with a consistent view across your portfolio, sectors, industries, and borrowers.

The Ultimate Guide: Commercial Lending & Scenario Analysis

“In working with OakNorth (Credit Intelligence), we’ve realized its ON Risk Score was so critical that they’re now preparing it for us on a quarterly basis, so we can now start developing trend analysis, which has been extremely critical in the identification of risk.”

“We’re moving very quickly into a world where data must be real time. If the most relevant data we have on a customer is a year old, that is a problem—both from a credit-risk perspective and from a regulatory perspective. So, OakNorth’s (Credit Intelligence) ability to provide us with real-time data and analytics on our borrowers is crucial to SMBC’s continued success.”

“Typically, banks only look at backward-looking, historic data. However, using the ON Credit Intelligence Suite, we're able to create a 360-degree, forward-looking view of borrowers by aggregating near real-time data."

Let's get ON with it

Request a personalized demo to discover what ONCI can do for your bank. What we’ll cover:

- Our products and how they can support you

- How rapidly you’ll see results

- Ease of installation and cost benefits