Portfolio Monitoring

Effectively manage risk, unlock efficiencies, and identify new growth opportunities

A holistic approach to portfolio monitoring

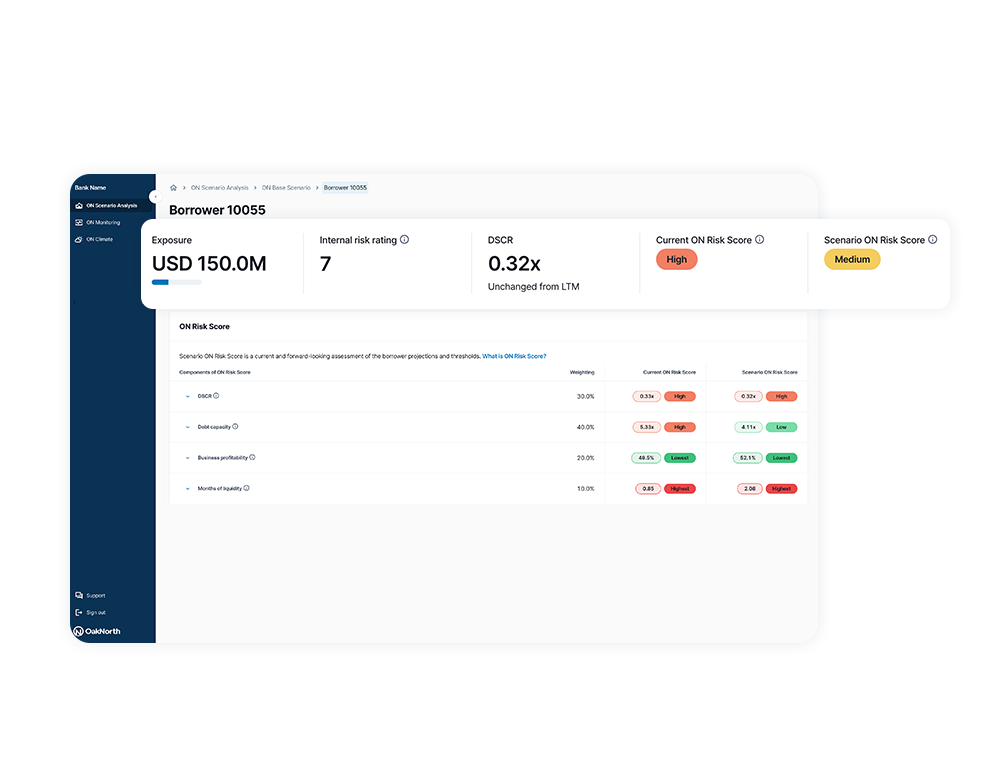

Monitor your commercial loan portfolio through our automated early warning system powered by trended historical financial information, internal and external peer data, and forecasted performance.

Identify credit deterioration early and take strategic, front-line actions to get ahead of negative credit outcomes.

Reduce the number of manual touchpoints in the annual review process, as well as the frequency and length of analysis.

Segment credits on a high to low-risk spectrum to identify which require intensive vs light touch reviews, freeing up resources to pursue new loan origination.

“Through the continuous monitoring of active credits, ONCI's software enables us to turn monitoring into a real-time process. This in turn means we can build deeper and more meaningful relationships with clients – having a consultative relationship with our borrowers – as well as ensuring our Relationship Managers have more time and better insights to originate new deals.”

Read the case study

“Typically, banks only look at backward-looking, historic data. However, using ONCI, we're able to create a 360-degree, forward-looking view of borrowers by aggregating near real-time data.”

Read the case study

“Through the continuous monitoring of active credits, OakNorth’s (Credit Intelligence) software enables us to turn monitoring into a real-time process. This in turn means we can build deeper and more meaningful relationships with clients – having a consultative relationship with our borrowers – as well as ensuring our Relationship Managers have more time and better insights to originate new deals.”

Read the case study

MANAGE RISK

Identify potential credit issues faster and earlier

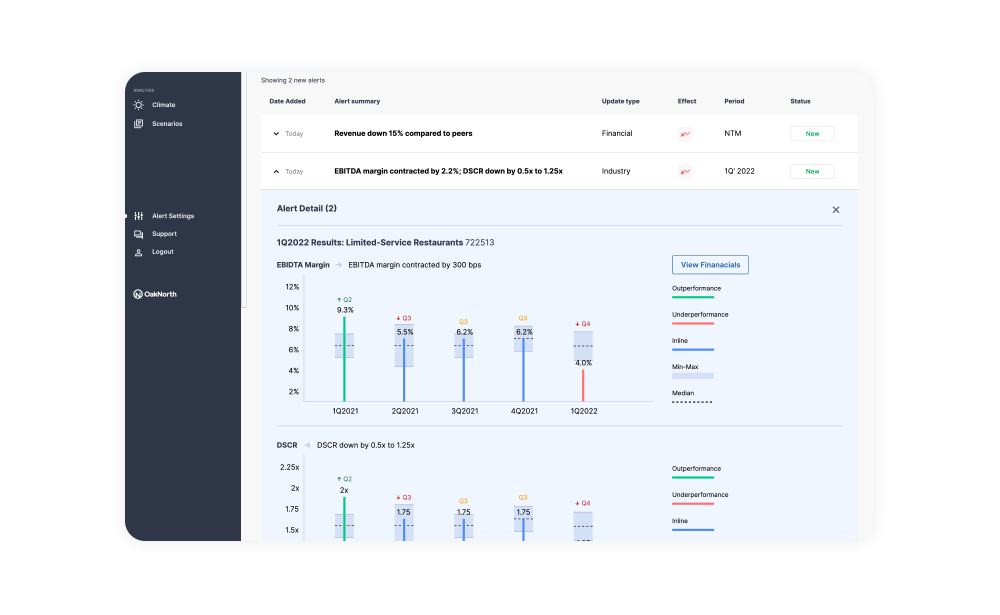

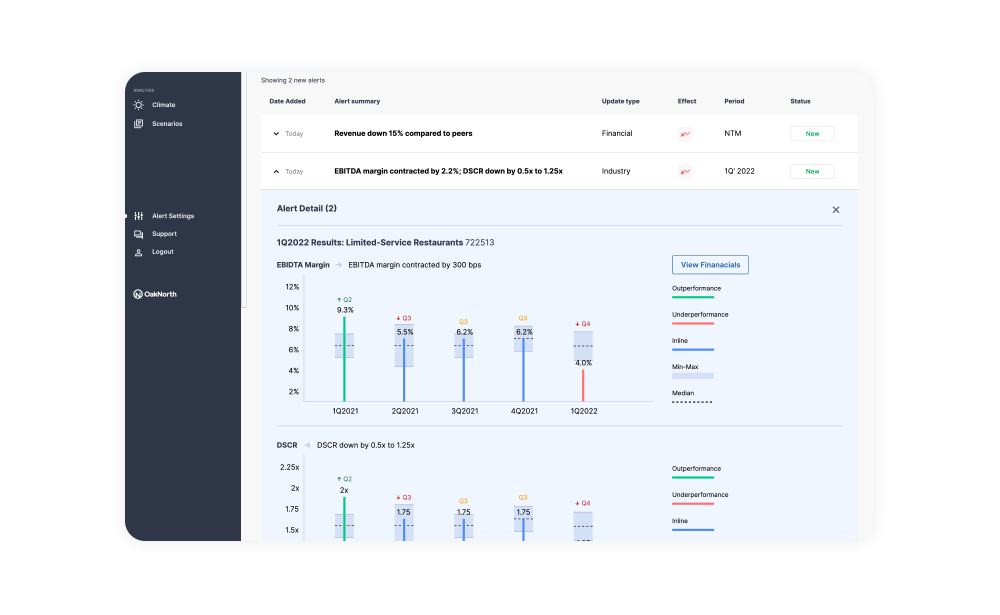

- Automated early warning indicators flag potential credit deterioration, enabling a faster response and better credit outcomes.

- Triage reviews to assess risker credits ahead of performing borrowers.

- Trended historical financial information, internal and external peer data, and forecasted performance at the borrower and portfolio level, so teams can focus on growing the portfolio while maintaining a strong credit risk culture.

MANAGE RISK

Identify potential credit issues faster and earlier, so you can take proactive actions to reduce the chances of negative outcomes for both you and your borrower

- Early warning indicators flag potential credit issues, enabling faster response and better credit outcomes

- Identify potential defaults and covenant breaches faster and earlier, minimizing defaults and credit losses

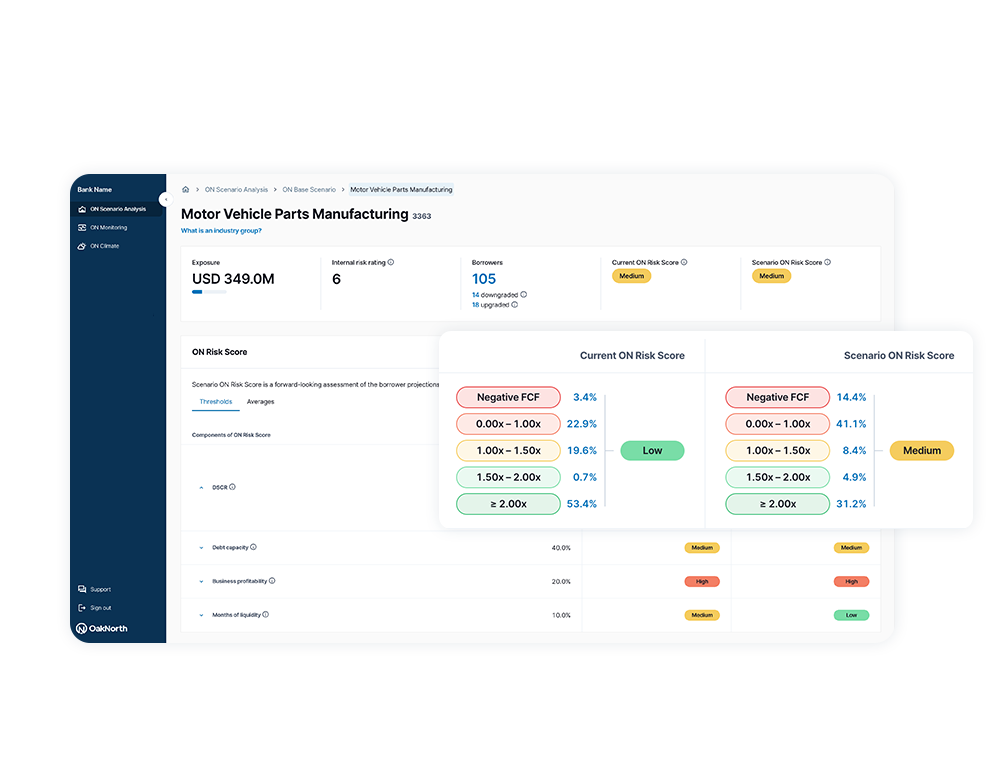

- Granular analysis to provide a better understanding of risk and more tailored credit policies

Unlock efficiencies

Data-driven credit intelligence that provides borrower-level insight

- Many banks are missing the consistent forward-looking analysis needed to develop and maintain a resilient portfolio monitoring strategy.

- They struggle to focus on origination because their time is consumed with managing risk.

- Our product provides actionable, proactive monitoring of the business in the portfolio beyond just monitoring covenants.

- Our "always-on" portfolio monitoring enables banks to save time on analyzing updated financials and industry events, streamlining review workflows

- It automates manual touchpoints enabling banks to conduct ongoing reviews vs point in time/annual reviews – saving time and unlocking efficiencies.

IMPROVE EFFICIENCY

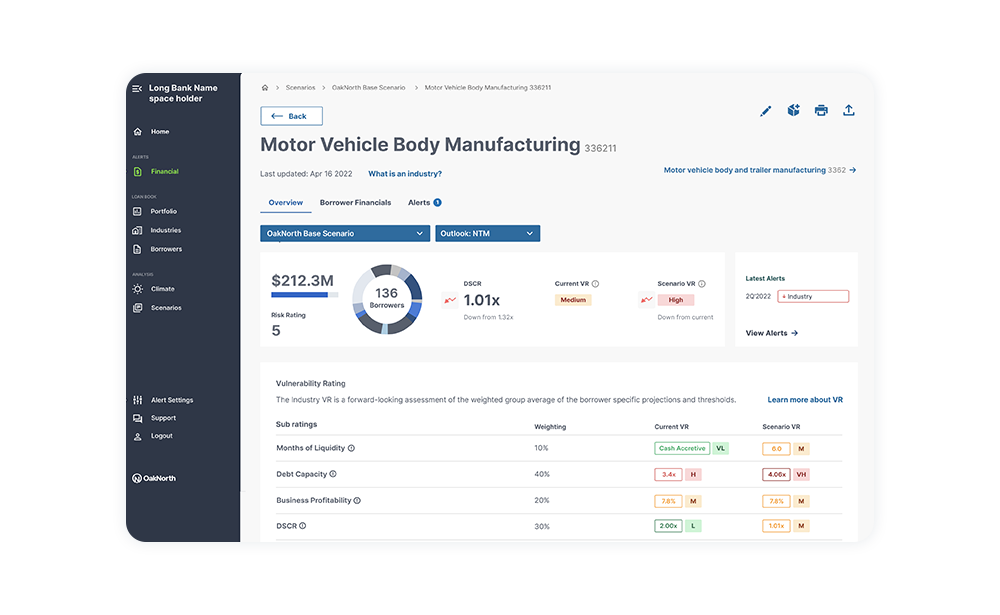

Manage your loan portfolio more efficiently with data-driven credit intelligence that provides granular, bottom-up, forward-looking insight

- Automate manual touchpoints to conduct ongoing reviews vs point in time/annual reviews – saving time and improving efficiency

- More actionable, proactive monitoring of the business in the portfolio vs monitoring of covenants

- Monitor loans with the same rigor as you underwrite them

- Incorporate scenario analysis, historical trends and peer performance into monitoring and reviews

- 273 industries and industry forecast models and L5 NAICS code analysis – get sector and peer insights with extreme granularity

Identify new growth opportunities

Focus on activities that benefit your bottom line

- Proactive monitoring with early warning indicators being driven by leading operating metrics, results in a ‘trusted partner’ status.

- Better relationships with customers by managing ahead of industry-driven financial hardship and potential default events.

- Lower losses means more capital available for lending.

Portfolio Monitoring Product Tour

Schedule a demo to find out how our Portfolio Monitoring product can help your bank increase efficiencies and manage risk with automated early warnings and prioritized reviews.

Let's get ON with it

Request a demo

Request a personalized demo to discover what ONCI can do for your bank. What we’ll cover:

- Our products and how they can support you

- How rapidly you’ll see results

- Ease of implementation and ROI