The future of commercial lending lies in leveraging artificial intelligence to enhance humans, not replace them

Sean Hunter, CIO at OakNorthApril 23, 2020

In recent years, hundreds of thousands of articles have been published about the inevitability of machines one day replacing humans. Some of the world’s greatest entrepreneurs and thinkers from Bill Gates to Elon Musk have predicted that artificial intelligence will “make jobs irrelevant”. In his book, End Times, Bryan Walsh argued that just as humans have used intelligence to rise to the top of the food chain despite being physically weaker and slower than many animals, so too could machines. In 2015, McKinsey published a report which claimed that 45 percent of the activities individuals are paid salaries for can be automated by adapting currently demonstrated technologies.

While there are many industries that could benefit greatly from increased, or indeed, full automation (e.g. driverless trains which could lead to fewer delays and the ability to invest more capital into upgrading the network – both of which would benefit customers), the technology still has a long way to go before it can do this, and the motivation for doing so needs to change. Historically, automation has been driven by a desire to cut costs, rather than to create a better customer experience. A simple example of this is with the replacement of human call centres across many types of businesses with chat bots or automated attendants. The sheer volume of calls many companies receive means that as they continue to grow, it gets increasingly expensive having a human on the other end of the phone. In the 90s, the “solution” to this was to outsource calls to developing markets where the cost of human capital is lower, but in recent years, many businesses have looked to technology as the answer.

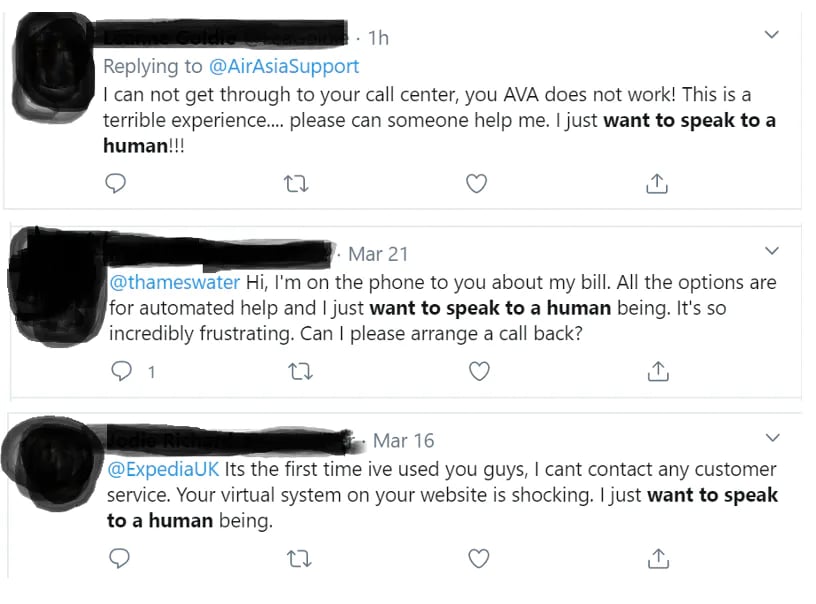

However, a quick search on Twitter returns hundreds of results from frustrated customers trying desperately to speak to a human to get their query resolved. Some businesses have therefore tried to adopt a hybrid of man and machine in the form of in-app chats whereby some of the responses are automated, but a human is still ultimately available so long as the customer is willing to wait for one to respond.

While I have no doubt that one day, these various technologies could create a better phone experience for the customer, right now, they tend to have the opposite effect – especially when it comes to financial services as money understandably makes people emotional.

And that’s really the crux of it – emotion.

At OakNorth, we focus on commercial lending to the “Missing Middle” – growth businesses who are the backbone of economies and communities globally, but who have been in banking’s blind spot for decades. Borrowing money is a highly emotional experience – from the reason why a business is wanting to borrow in the first place (i.e. to grow, to protect it from future unknowns, to maintain control vs taking equity investment, etc.), to who the business chooses to take money from (is this lender the right partner? Do they really understand my business?)

Technology investment in commercial lending has historically been focused on retail and small business loans ($500k or less) where the process is fully-automated, and the borrower can have a decision within minutes without having to interact with a human at any stage. Think about the experience you had when you last applied for a credit card for example – chances are that you didn’t encounter a human at any point in the process. Humans have been completely removed from the decision workflow and replaced by technology. Meanwhile, the approach with medium-sized loans ($500k to $25m) has shifted from what it used to be four decades ago where local branch managers with knowledge of the surrounding community could make credit decisions, to today where there’s centralised decision making and opaque “computer-says-no" decisions. Why is this? Because the human element of in-depth credit analysis has traditionally made it a very manual process that is time-intensive and costly.

At OakNorth, we are addressing this challenge via our Credit Intelligence Suite, which leverages machine learning, decades of credit expertise and massive data sets (including unconventional and previously unavailable data) to enhance the human. The suite enables our bank partners around the world to do the in-depth credit analysis that enables them to provide businesses with the type of bespoke deal structuring that’s typically reserved for large corporations. In doing so, OakNorth Credit Intelligence enables our partners to have fundamentally different conversations and engage with borrowers in a dramatically different way. It brings credit insight about borrowers’ businesses back to the front line, democratizing this knowledge so that the banks relationship managers have a deep understanding of the individual business, its industry and its sub-sector. As a result, they have more relevant and thoughtful conversations with the business owner and can build much more meaningful relationships with them. Instead of wasting time on the things that don’t matter, they are able to spend more time on the things that do – structuring a loan for our borrowers’ needs in the time frame they need it, as well as exploring cross-selling opportunities.

The suite doesn’t only assist bank partners with credit analysis and data optimisation, it also aids in their portfolio monitoring. By proactively monitoring clients’ financial and operational data, it is able to provide early warning indicators in case of deterioration in credit quality, enabling relationship managers to have a preliminary conversation with the borrower, well before a negative credit issue arises. This results in better outcomes for the borrower as well as the bank and can be evidenced by OakNorth Bank’s success in the UK. It was the first bank to leverage the OakNorth Credit Intelligence Suite and since its launch in September 2015, has lent over $5bn (£4bn) with no credit losses and only two defaults, whilst achieving profitably from year one, an RORE of 22 percent and a cost to income ratio of 26 percent.

The key to successfully lending to the Missing Middle therefore lies in leveraging artificial intelligence to minimise time, effort and risk at the back-end, so that banks have more opportunities to delight their customers and forge genuine relationships at the front-end.