Understand the risks and seize the opportunity

Operationalize climate risk with detailed data, outputs, and tools reflecting how climate change impacts C&I and CRE portfolios - down to the individual borrower level.

See climate-adjusted credit parameters to arrive at Probability of Default and Loss Given Default to help you manage portfolio risks.

Confidently report on portfolio and borrower-level outputs supported by explainable models, improving transparency in reporting.

Leverage proprietary data and tools that align with evolving industry standards (NGFS, PCAF, TCFD, ISSB) to meet regulatory requirements at scale.

Calculate financed emissions (PCAF score 3 / 4) across your entire loan book.

Total Climate: Celent Model Risk Award Winner

Total Climate has enabled Fifth Third Bank to quantify its climate risk in commercial lending, guide future conversations with our commercial borrowers, and enable us to continue our climate leadership through disclosure - earning it the 2023 Celent Model Risk Award.

RISK MANAGEMENT

Identify and measure climate risks

- Most banks struggle to assess climate risks in their commercial portfolios, lacking the detailed data needed to determine how climate change is impacting their C&I and CRE customers.

- Total Climate uses property data, borrower financial data and disclosures, enabling banks to accurately identify, measure and monitor climate risk across their portfolios.

FINANCED EMISSIONS

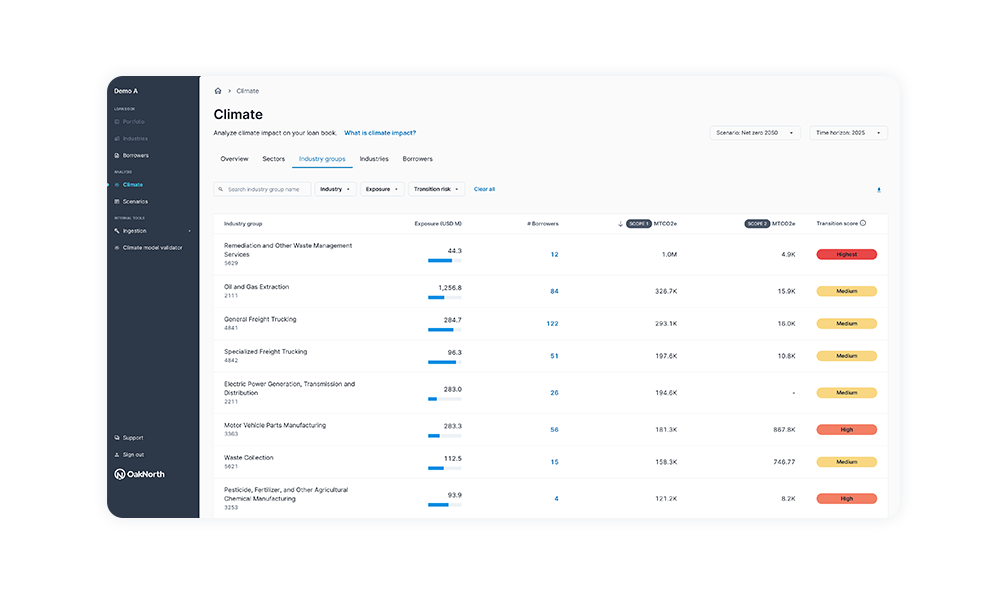

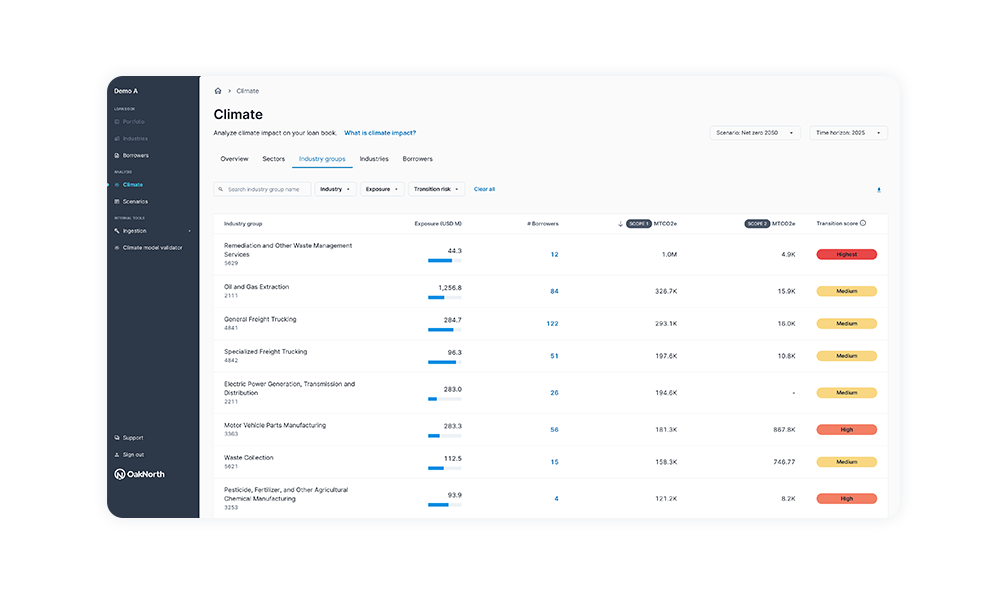

Identify and report on financed emissions in your loan book, without wasting time on data collection

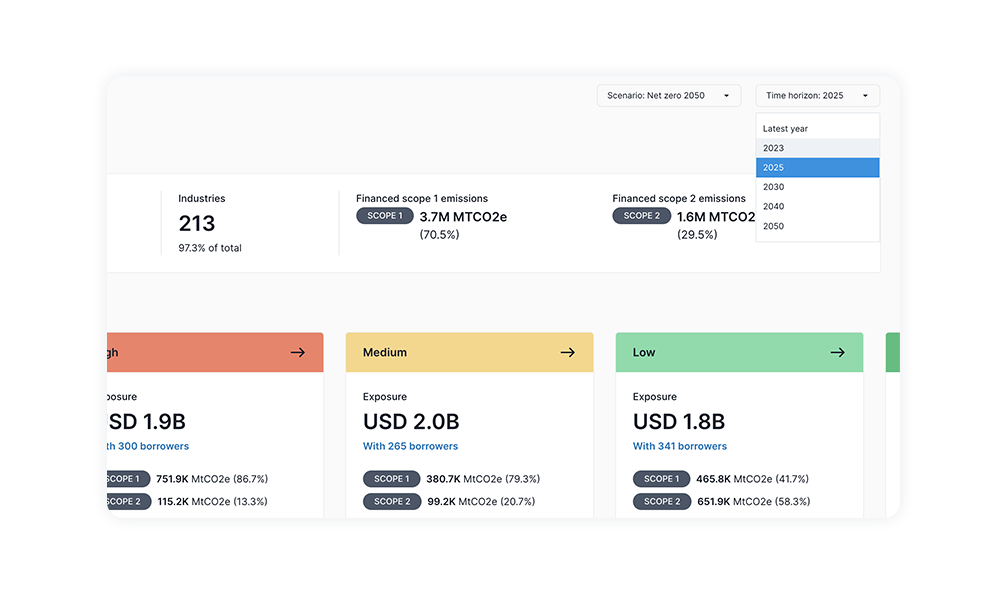

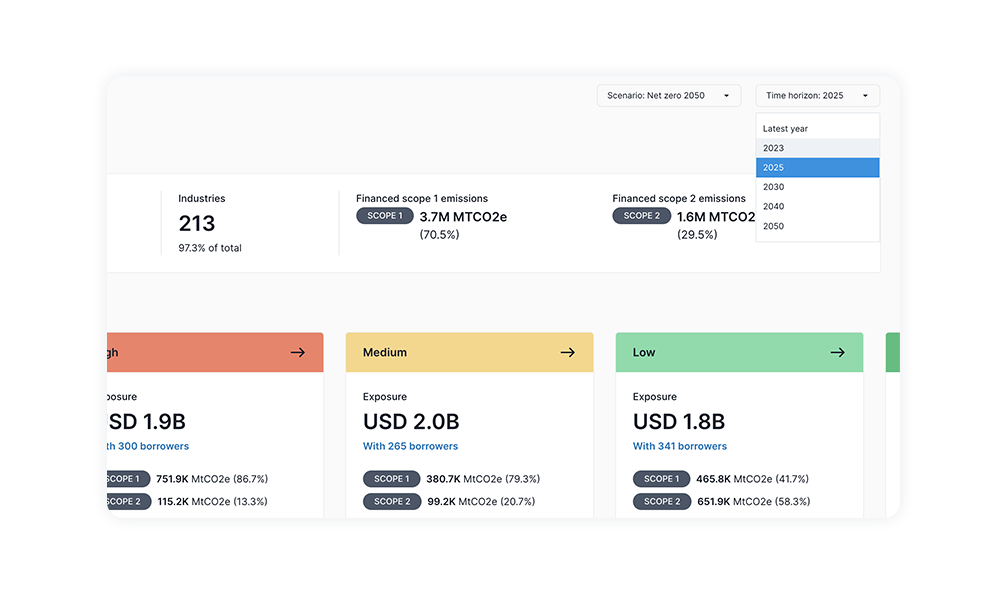

- Calculate emissions at the portfolio, sector, industry and borrower level, while adhering to PCAF score 3 and 4 reporting

- Analyze and report on Scope 1 and Scope 2 financed emissions across six NGFS climate scenarios and five-time horizons for strategic planning while keeping the cost of reporting low

REGULATORY COMPLIANCE

Navigate evolving regulatory requirements

- Between the Fed’s Interagency Guidance, the Fed CSA, the OCC’s focus reviews, SEC disclosures, and individual state laws, keeping up with regulatory requirements is resource-intensive.

- Total Climate helps close capability gaps efficiently, cost-effectively and transparently, enabling banks to prepare for regulatory expectations with fewer resources.

REGULATORY REPORTING

Identify climate risk in your portfolio early and mitigate regulatory risk

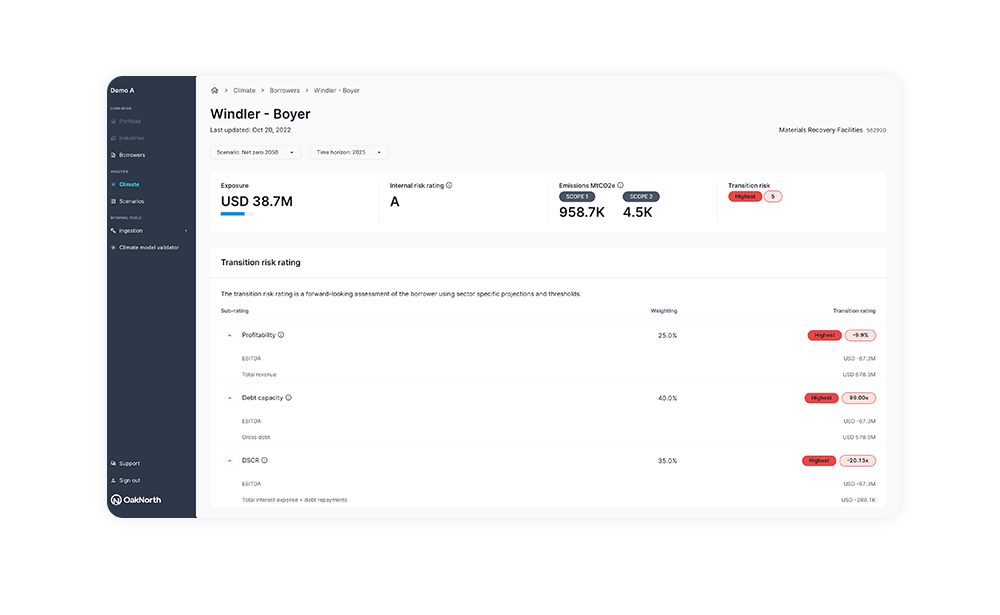

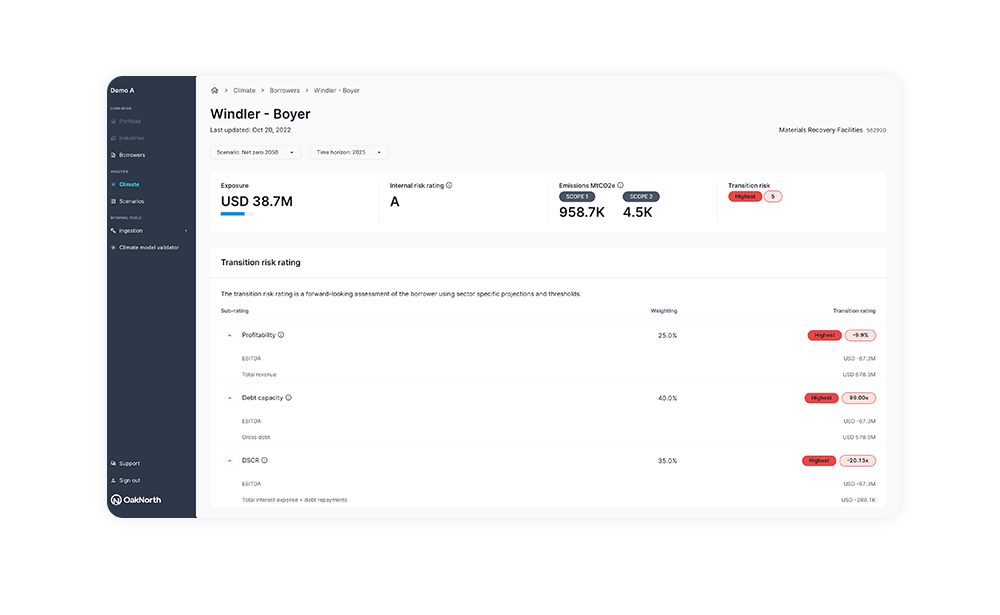

- Plan ahead for market changes and formulate targeted risk mitigation strategies by identifying high risk sectors, industries and borrowers in your loan book

- Analyze ON Climate Transition Score (highest to lowest) alongside your existing credit risk ratings and stack rank the portfolio for priority deep dives and climate-focused review

- Use shorter NGFS timelines of 3-5 years to make climate decisions on your portfolio now

- Understand the impact of climate risk on borrower financials and credit health and extract climate risk-based financial forecasts for risk quantification

FIND OPPORTUNITY

Strengthen relationships with customers, improve retention, and increase wallet share by helping borrowers transition

- Guide your borrowers towards collecting and tracking emissions data and technology changes

- Understand the levers (technology, regulatory) driving transition risk in borrowers’ business models to inform meaningful conversations with borrowers around decarbonizing their business

- Lend into more decarbonizing ventures and lower overall emissions to improve your NPS and brand value

FIND OPPORTUNITY

Strengthen relationships with customers, improve retention, and increase wallet share by helping borrowers transition

- Guide your borrowers towards collecting and tracking emissions data and technology changes

- Understand the levers (technology, regulatory) driving transition risk in borrowers’ business models to inform meaningful conversations with borrowers around decarbonizing their business

- Lend into more decarbonizing ventures and lower overall emissions to improve your NPS and brand value

Total Climate: Product Tour

Schedule a demo to find out how Total Climate can help your bank effectively, efficiently and transparently evaluate, measure, and report on climate-related risk and financed emissions.

Let's get ON with it

Request a personalized demo to discover what ONCI can do for your bank. What we’ll cover:

- Our products and how they can support you

- How rapidly you’ll see results

- Ease of installation and cost benefits